ASC 606 (Accounting Standards Codification Topic 606) and IFRS 15 (International Financial Reporting Standard 15) are both accounting standards that provide guidance on revenue recognition. They were jointly issued by the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) in May 2014 and became effective for public companies in 2018.

The significance of ASC 606/IFRS 15 lies in its comprehensive approach to revenue recognition, which is intended to improve the consistency and comparability of financial reporting across different industries and geographic regions. The standard requires companies to recognize revenue when goods or services are transferred to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services.

This new standard replaces many of the previous revenue recognition rules that varied by industry, and it introduces new requirements for companies to identify and allocate the transaction price to performance obligations, as well as to estimate the amount of variable consideration that may be included in the transaction price. Additionally, the standard requires enhanced disclosures about the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers.

Importance Of Managing Compliance In Sales Compensation To Ensure Accuracy And Transparency

Managing compliance in sales compensation is crucial for ensuring accuracy and transparency in the payment of incentives to sales representatives. Compliance involves adhering to legal and regulatory requirements, as well as internal policies and procedures, to avoid potential violations and penalties that could result from noncompliance.

By ensuring compliance in sales compensation, companies can minimize the risk of errors and disputes, which could damage employee morale and erode trust in the incentive program. Additionally, transparency in the compensation process can help build trust and promote a culture of fairness and equity among sales teams.

Effective compliance management in sales compensation also helps companies to identify and mitigate potential risks and exposures, such as misinterpretation of compensation plans or failure to pay out incentives correctly. This can save companies from costly litigation, reputational damage, and loss of productivity.

Overview of ASC 606/IFRS 15 and its key provisions

ASC 606 (Accounting Standards Codification Topic 606) and IFRS 15 (International Financial Reporting Standard 15) are global accounting standards for revenue recognition that were jointly issued by the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) in May 2014. The standards provide guidance on the recognition, measurement, and disclosure of revenue arising from contracts with customers.

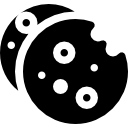

The key provisions of ASC 606/IFRS 15 include:

- Identification of the contract: The standard requires companies to identify the contract with a customer, which can be written or oral, and includes the terms and conditions of the arrangement.

- Performance obligations: Companies must identify the distinct performance obligations within the contract, which are promises to transfer goods or services to the customer.

- Transaction price: The transaction price is the amount of consideration to which the company expects to be entitled in exchange for transferring the promised goods or services.

- Allocation of the transaction price: The transaction price must be allocated to each distinct performance obligation based on its relative standalone selling price.

- Timing of revenue recognition: Revenue is recognized when control of the promised goods or services is transferred to the customer, which may be at a point in time or over time.

- Variable consideration: The standard requires companies to estimate the amount of variable consideration that may be included in the transaction price, such as discounts, rebates, or incentives, and adjust the transaction price accordingly.

- Contract costs: Incremental costs of obtaining a contract and fulfilling the contract must be recognized as an asset if they meet certain criteria.

- Disclosure: Companies must provide enhanced disclosures about revenue and cash flows arising from contracts with customers, including information about the nature, amount, timing, and uncertainty of revenue and cash flows.

ASC 606/IFRS 15 represents a comprehensive and principles-based approach to revenue recognition that aims to provide greater consistency and comparability across industries and geographic regions. It is important for companies to carefully evaluate their contracts and revenue recognition policies to ensure compliance with the new standard and provide transparent and accurate financial reporting to stakeholders.

Implications for Sales Compensation

ASC 606/IFRS 15 has significant implications for the calculation of commissions in sales compensation plans, as it changes the way revenue is recognized and allocated. The new standard requires companies to identify and allocate the transaction price to performance obligations, which could affect the amount and timing of revenue recognized, and therefore, the amount of commission paid to sales representatives.

Under the previous revenue recognition standards, companies typically recognized revenue when the sale was completed or the service was rendered. However, ASC 606/IFRS 15 requires revenue to be recognized when control of the promised goods or services is transferred to the customer, which may occur at a point in time or over time.

Discussing how ASC 606/IFRS 15 affects the calculation of commissions

This change could impact the timing of revenue recognition for sales transactions, which could in turn affect the calculation of commissions. For example, if a sales representative is paid a commission based on a percentage of revenue recognized, the amount of commission may change depending on when the revenue is recognized under ASC 606/IFRS 15.

Additionally, the new standard requires companies to estimate the amount of variable consideration that may be included in the transaction price, such as discounts, rebates, or incentives, and adjust the transaction price accordingly. This could impact the calculation of commissions if they are based on the transaction price, as the commission may need to be adjusted based on the estimated variable consideration.

In some cases, the new standard may also require companies to recognize revenue for some types of contracts earlier or later than they would have under the previous standards. This could impact the timing of commission payments for sales representatives, as the commission may be calculated based on revenue recognized in a different period than under the previous standards.

Here are some of the key impacts on sales compensation plans and structures:

- Timing of commission payments: The timing of commission payments may be impacted by the new revenue recognition rules. If revenue is recognized at a different time than under the previous standards, this could impact the timing of commission payments.

- Revision of commission structures: Companies may need to revise their commission structures to ensure that they align with the new revenue recognition rules. This may involve changes to commission rates or considerations to reflect the new revenue recognition criteria.

- Estimation of variable compensation: Companies must estimate variable consideration, such as discounts, rebates, or incentives, and adjust the transaction price accordingly. This could impact the calculation of commissions if they are based on the transaction price, as the commission may need to be adjusted based on the estimated variable consideration.

- Review of sales contracts: Companies may need to review their sales contracts to ensure that they comply with the new revenue recognition rules. This may involve updating contract language or revising contract terms to ensure compliance with the new standards.

- Enhanced disclosure requirements: The new revenue recognition rules require enhanced disclosures about revenue and cash flows arising from contracts with customers. Companies may need to provide additional information about their revenue recognition policies and practices to ensure transparency and compliance with the new standards.

- Additional resources and software: Companies may need to allocate additional resources or invest in software to manage the commission process effectively and ensure compliance with the new standards.

Key Considerations for Compliance

Compliance with ASC 606/IFRS 15 requires careful consideration of several key factors. Here are some of the key considerations for compliance:

- Contract analysis: Companies must analyze their contracts to identify the performance obligations and determine the timing of revenue recognition. This requires a detailed understanding of the contract terms and how they impact revenue recognition.

- Recognition of commissions: Companies must understand how commissions should be recognized under ASC 606/IFRS 15. This includes considering how commissions should be allocated to performance obligations and how they should be recognized over time.

- Contract modifications: Companies must address the impact of contract modifications on revenue recognition and sales compensation. This requires careful analysis of any changes to the contract terms and how they impact revenue recognition and commission calculations.

- Disclosure requirements: ASC 606/IFRS 15 includes enhanced disclosure requirements related to revenue and cash flows arising from contracts with customers. Companies must ensure that they are providing the required disclosures in their financial statements and other public filings.

- Technology and software: Compliance with ASC 606/IFRS 15 may require additional resources and investment in technology and software to manage the complex calculations and reporting requirements.

- Training and education: Companies may need to provide training and education to employees and stakeholders on the new revenue recognition rules and how they impact sales compensation. This can help ensure that everyone understands the changes and can adapt to them effectively.

Strategies for Successfully Managing Compliance

Successfully managing compliance with ASC 606/IFRS 15 requires a comprehensive approach that involves collaboration between different departments, robust contract management, and comprehensive disclosures. Here are some strategies for managing compliance:

- Cross-functional collaboration: Compliance with ASC 606/IFRS 15 requires collaboration between finance, sales, legal, and IT departments. It is essential to have open lines of communication and regular meetings to discuss compliance issues and ensure that everyone is on the same page.

- Robust contract management: A key aspect of compliance is having an efficient contract management system in place. This involves ensuring that contracts are properly reviewed, analyzed, and updated to reflect the new revenue recognition rules. It also involves having a system for tracking changes to contracts and monitoring compliance.

- Comprehensive disclosures: Compliance with ASC 606/IFRS 15 requires comprehensive disclosures about revenue and cash flows arising from contracts with customers. Companies must ensure that their disclosures are transparent and accurate, and that they provide the required information to stakeholders.

- Training and education: It is important to provide training and education to employees and stakeholders on the new revenue recognition rules and how they impact sales compensation. This can help ensure that everyone understands the changes and can adapt to them effectively.

- Monitoring and review: Compliance with ASC 606/IFRS 15 is an ongoing process that requires regular monitoring and review to ensure that policies and procedures are working effectively. Companies should establish a system for reviewing contracts, disclosures, and commission calculations to ensure ongoing compliance.

Successfully managing compliance with ASC 606/IFRS 15 requires a coordinated effort between different departments, robust contract management, comprehensive disclosures, and ongoing monitoring and review. By implementing these strategies, companies can ensure that they remain compliant with the new revenue recognition rules and avoid potential risks and penalties.

Conclusion

In conclusion, ASC 606/IFRS 15 represents a significant shift in revenue recognition standards, which can impact sales compensation plans and structures. The new standard requires companies to identify and allocate the transaction price to performance obligations, which may impact the amount and timing of revenue recognized, and therefore, the amount of commission paid to sales representatives.

Successfully managing compliance with ASC 606/IFRS 15 requires a comprehensive approach that involves collaboration between different departments, robust contract management, comprehensive disclosures, and ongoing monitoring and review. Companies must carefully evaluate their compensation policies and practices to ensure compliance with the new standard and accurately calculate commissions. This may require changes to commission structures or performance metrics to align with the new revenue recognition rules and ensure that commissions are calculated accurately and fairly.

Compliance with ASC 606/IFRS 15 is essential for accurate and transparent financial reporting, and failure to comply can result in penalties and reputational damage. Therefore, it is crucial for companies to stay up-to-date with regulatory changes and ensure ongoing compliance with the new standards.

Find out how Compport can help you manage all your Compliances in Compensation Management process, book a demo today!

%2520(6)%2520(2).avif)

Frequently Asked Questions

Q1. What are ASC 606 and IFRS 15?

ASC 606 (Accounting Standards Codification Topic 606) and IFRS 15 (International Financial Reporting Standards 15) are revenue recognition standards that define how and when a company recognizes revenue. ASC 606 is enforced by the Financial Accounting Standards Board (FASB) in the United States, while IFRS 15 is enforced by the International Accounting Standards Board (IASB) globally. These standards require that revenue is recognized when a customer obtains control of a good or service.

Q2. How does ASC 606/IFRS 15 impact sales compensation?

ASC 606/IFRS 15 may impact sales compensation in various ways. If a company's sales compensation plan includes clauses that link compensation to revenue recognition, adjustments may be required to align with these standards. For example, if a salesperson is paid commission upon closing a deal, but the revenue from that deal is recognized over time (as required by ASC 606/IFRS 15), the company must determine how to handle this discrepancy. This can potentially affect sales compensation planning, commission calculations, and payout timings.

Q3. What are the key steps to ensure sales compensation compliance with ASC 606/IFRS 15?

Key steps include:

- Understanding the implications of ASC 606/IFRS 15: The first step is to understand how these standards affect your company's revenue recognition and, subsequently, sales compensation.

- Reviewing sales compensation plans: Existing sales compensation plans should be reviewed to identify any potential conflicts with ASC 606/IFRS 15.

- Adjusting sales compensation plans: Necessary adjustments should be made to the sales compensation plans to ensure they comply with ASC 606/IFRS 15.

- Training and communication: It's important to educate salespeople and other stakeholders about these changes and how they affect their compensation.

- Implementing tracking and reporting systems: Adequate systems should be put in place to track and report revenue as per ASC 606/IFRS 15.

Q4. Can technology help in managing ASC 606/IFRS 15 compliance in sales compensation?

Yes, technology can significantly aid in managing ASC 606/IFRS 15 compliance. Specialized sales compensation software can automate compensation calculations, factoring in new revenue recognition rules. This not only ensures compliance but also improves efficiency and accuracy. It also provides clear documentation and audit trails, which are vital for demonstrating compliance.

Q5. What are the risks of non-compliance with ASC 606/IFRS 15 in sales compensation?

Non-compliance with ASC 606/IFRS 15 can result in inaccurate financial reporting, which can have serious consequences, including regulatory penalties and damage to the company's reputation. It could also lead to internal issues, such as disputes over sales compensation, decreased sales team morale, and productivity due to uncertainties over earnings. Therefore, it's crucial for businesses to ensure their sales compensation practices comply with these standards.

.svg)

%20(54).png)

%20(53).png)

%20(52).png)