Brazil took a bold step forward in July 2023, joining the global movement toward workplace equality by introducing its pay transparency law. While this marks Latin America's most significant move in addressing wage gaps, it also opens new conversations about how organizations approach compensation fairness.

But implementing transparency isn't that simple.

Pay transparency in Brazil represents an opportunity to reshape how organizations approach compensation and equality in the modern workplace – creating a more inclusive and equitable future for all employees.

In this guide, we will take you through the nitty-gritty of pay transparency law in Brazil and suggest practical strategies to help employers navigate this maze.

Let’s go!

What is the Current State of Pay Transparency in Brazil?

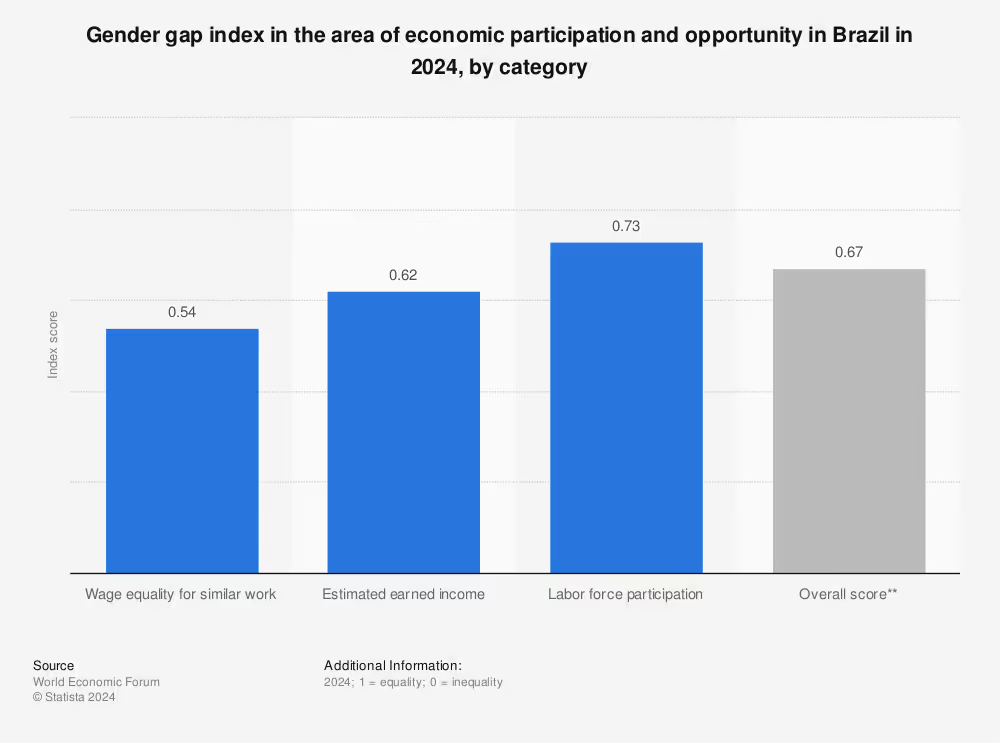

According to the World Economic Forum's 2023 Global Gender Gap Report, women earn, on average, 19.4% less than men in similar positions.

The latest survey by Statista shows that women are at a 46% disadvantage in wage equality for similar work, scoring just 0.54 on the equality index, where 1.0 represents perfect equality.

The urgency is clear. But the good news is the country is taking all the preventive measures to avoid similar instances of pay gaps.

Brazil has launched significant measures to address workplace compensation equality in 2023.

Here’s a quick sneak peek into it before we get to the details:

The regulatory framework comprises three key components working together to enforce pay transparency:

- The Equal Pay Law (Law 14.611/2023), which established the foundational requirements in July 2023

- Federal Decree No. 11,795/2023 (November 23, 2023), which provided detailed implementation guidelines

- Ordinance 3,714/2023 (November 24, 2023), which outlined administrative procedures and reporting mechanisms

Brazil's approach differs from other global initiatives in that it places the responsibility for report generation on the government rather than employers. Companies provide data through established platforms, and the Ministry of Labor generates standardized transparency reports based on this information.

💡Learn about pay transparency laws in the following countries:

What should Employers Know about Brazil Pay Transparency Law?

Companies operating in Brazil face new reporting mandates designed to create transparency in compensation practices. Under the current framework, obligations vary based on specific criteria and timelines.

We have summarized the details in the table below:

📚Learn the jargon

- Thirteenth salary: Annual year-end bonus equal to one month's salary (mandatory in Brazil)

- Career framework documentation: Formal structure showing job levels, requirements, and progression paths

- Hazard pay: Additional compensation for work in dangerous or unhealthy conditions

Unlike other jurisdictions, Brazilian employers do not create their transparency reports. Instead, the Ministry of Labor generates standardized reports using submitted data. Companies must maintain comprehensive documentation to support their submissions and demonstrate compliance with equal pay requirements.

The data requirements emphasize both quantitative compensation information and qualitative workplace policies, creating a holistic view of pay equity practices

Regulatory Framework Related to Brazil Pay Transparency Law

Brazil's pay transparency regulations create a three-tiered structure, with each component addressing specific aspects of implementation and compliance. Below are the details:

The regulatory framework mandates that the Ministry of Labor, not employers, generate transparency reports using submitted data. This centralized approach aims to create consistency but has raised concerns about data interpretation and accuracy.

What are the Compliance Deadlines and Reporting Cycles for Brazil Pay Transparency Laws?

Here's a comprehensive breakdown of key deadlines and cycles:

Current compliance status:

- As of August 31, 2024, only 31,936 out of an estimated 52,000 eligible companies had submitted required data

- The Ministry of Labor has shown initial leniency but may increase enforcement for upcoming cycles

What are the Penalties associated with Brazil Pay Transparency Law?

Brazil's pay transparency law establishes significant consequences for employers who fail to comply with reporting requirements or maintain discriminatory pay practices.

Here's what employers need to know about enforcement and penalties:

Report non-publication penalties

The Ministry of Labor can impose fines of up to 3% of a company's payroll for failing to publish transparency reports. These fines are capped at 100 minimum wages, currently equating to approximately USD 28,250. The Ministry initially showed leniency during the first reporting cycle but has indicated stricter enforcement moving forward.

Pay discrimination consequences

When pay discrimination is identified, penalties become more severe:

- Companies must pay affected employees 10 times their new monthly salary

- This penalty doubles for repeat violations

- Companies must also pay any wage differences owed retroactively

- Employees can pursue additional compensation through moral damages claims

Additional financial liabilities

Beyond direct penalties, companies may face:

- Legal costs and attorney fees

- Compensatory damages in civil actions

- Administrative fines from regulatory bodies

- Expenses related to implementing required action plans

Enforcement mechanisms

Multiple authorities oversee compliance:

- The Ministry of Labor monitors report submissions and reviews data

- The Public Labor Prosecutor's Office investigates discrimination complaints

- Labor courts enforce penalties and hear employee claims

- Unions participate in the oversight of action plan implementation

Enforcement process

The enforcement process typically follows these steps:

- Data review and report generation by the Ministry

- Notification of violations to companies

- The 90-day window for action plan development

- Implementation monitoring

- Penalty assessment for non-compliance

Companies should note that while initial enforcement has been measured, authorities have indicated increased scrutiny for future reporting cycles.

What Challenges can Employers Face when Implementing Brazil Pay Transparency Law?

While Brazil's pay transparency law marks a significant step toward workplace equality, employers face numerous practical challenges that complicate their efforts to implement these well-intentioned requirements effectively and accurately.

The messy reality of data collection and accuracy

Most employers struggle with the government's data interpretation methods. For example, when the Brazilian Occupational Classification (CBO) groups a senior software engineer with five years of experience alongside an entry-level developer, it creates misleading pay gap data.

In March 2024, companies reported artificially high gender pay gaps averaging 19.4% - numbers that didn't reflect legitimate factors like experience and performance. The standardized grouping system often needs to account for nuanced differences in roles, responsibilities, and qualifications that legitimately impact compensation.

Wrestling with unclear legal requirements

The law's rapid implementation has left many questions unanswered. For instance, companies must involve unions in action plans but receive no guidance on how this collaboration should work.

Some organizations have sought legal injunctions to pause reporting requirements until these uncertainties are resolved. The need for clear guidelines on how to justify legitimate pay differences or what constitutes an acceptable action plan creates significant compliance risks.

Everyday operational headaches

Companies need to work on meeting requirements. Consider a multinational company with offices across Brazil - they must coordinate data collection across multiple locations while standardizing job classifications between different departments.

Organizations must navigate varying regional compensation practices while maintaining consistent reporting across local office differences. The operational complexity increases with company size and geographic spread.

Finding resources in tight budgets

Organizations need significant resources to comply with the law. This includes investment in data management systems and dedicating staff time for report preparation and submission. Companies must also budget for training HR teams on new requirements, securing legal counsel for compliance review, and potentially hiring additional personnel for action plan development. These costs can be particularly challenging for mid-sized companies over the 100-employee threshold.

When reports are out of your hands

Unlike other countries where companies prepare their reports, Brazilian employers must rely on government-generated analyses. This creates challenges when companies cannot provide context for pay difference, or the questionnaire format restricts explanations.

Using historical data from 2022 without consideration of recent changes further complicates the picture. Organizations have no opportunity to review reports before publication, potentially leading to misrepresentation of their compensation practices.

The privacy versus transparency tightrope

Companies must carefully manage individual employee data protection while complying with Brazil's data protection law (LGPD). Providing sufficient detail in public reports while protecting competitive information creates a delicate balance.

For example, companies struggle to provide meaningful data while maintaining employee privacy in smaller departments where individual salaries might be identifiable.

💡Learn about pay transparency laws in the following US states:

How to Implement Transparency Law Successfully in Brazil? Practical Tips for Employers

As Brazil's pay transparency requirements take shape, companies can take proactive steps to ensure compliance while building a genuinely equitable workplace. Here's a practical roadmap for successful implementation.

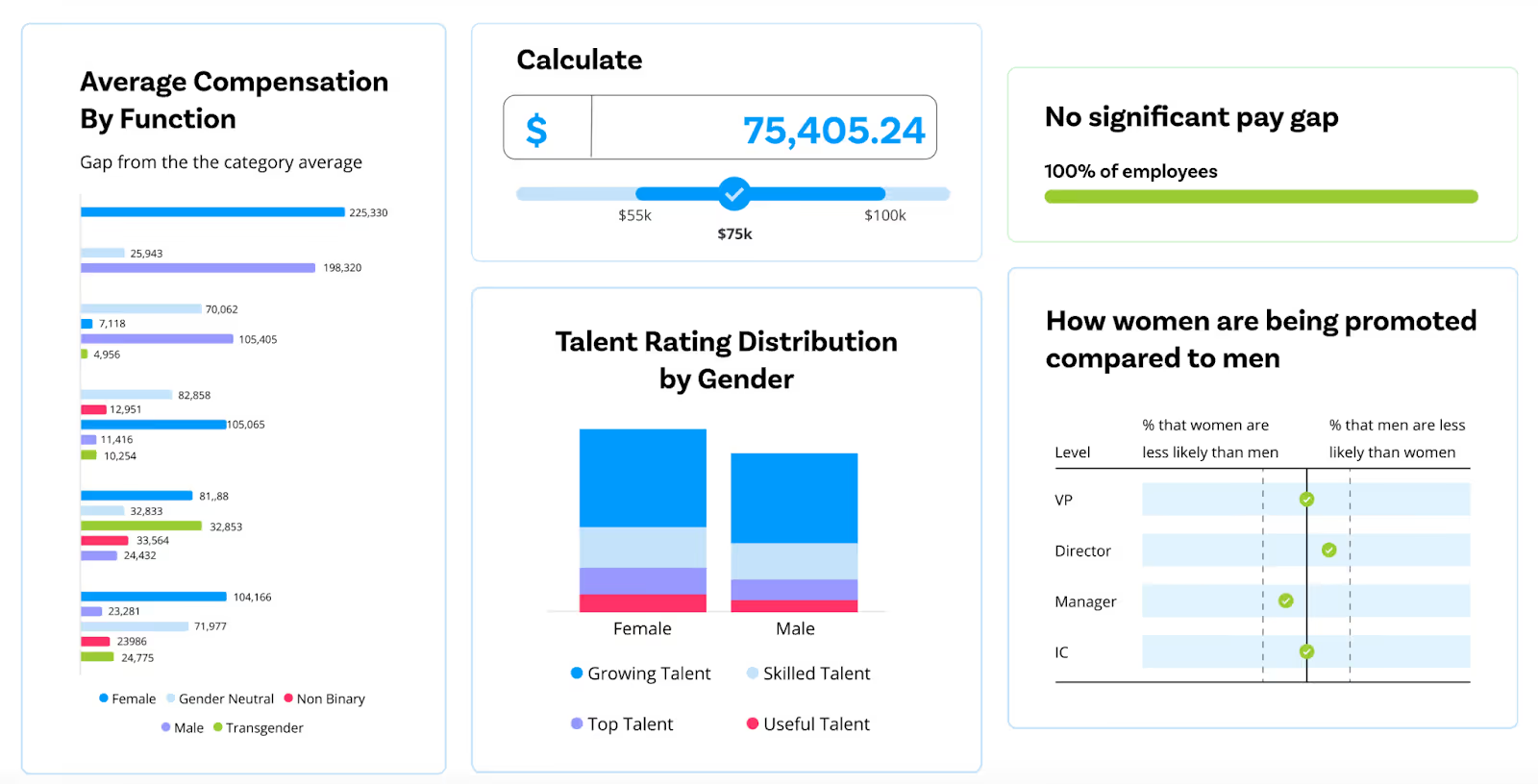

Invest in specialized pay equity automation

Manual spreadsheet tracking can lead to errors and inconsistencies in pay equity management. To streamline the process, consider implementing dedicated software solutions like Compport's Pay Equity Management platform.

For instance, Compport helps organizations design and maintain compensation bands aligned with their pay practices, automatically evaluate data to eliminate anomalies and provide customized dashboards for tracking key metrics like pay equity gaps and compa ratios.

This systematic approach helps meet compliance requirements and provides actionable insights for maintaining equitable pay practices.

Start with a thorough pay equity audit

Begin by examining your current compensation structure through detailed analysis. A pay equity audit helps review base salaries, bonuses, benefits, and career advancement patterns across gender, race, and other protected characteristics. Many companies find that departments with similar titles, but vastly different responsibilities often reveal hidden pay disparities that need addressing before government reporting.

Build clear compensation policies and frameworks

Develop documented criteria for setting and adjusting compensation. For instance, create salary bands for each role with clear progression metrics. Some organizations establish point-based systems that objectively evaluate experience, education, and performance to determine pay levels. This creates defensible rationales for pay differences when questioned.

Make training your competitive advantage

Invest in comprehensive training programs that go beyond essential compliance. Focus on helping managers understand their role in maintaining pay equity through hiring, promotion, and compensation decisions. One practical approach includes regular workshops where managers practice using the new compensation frameworks with real-world scenarios.

Create robust documentation systems

Establish processes to track every pay-related decision and its justification. For example, maintain detailed records of performance reviews, skill assessments, and career development plans that support compensation changes. This documentation becomes crucial when preparing government submissions or responding to inquiries about pay disparities.

Prioritize ongoing monitoring and adjustment

Implement regular check-ins rather than waiting for government reporting deadlines. Consider quarterly reviews of compensation data to identify and address potential issues early. Tools like spreadsheet templates or specialized software can help track progress and flag concerning patterns before they become significant problems.

Stay at the top of pay transparency with Compport

Brazil's pay transparency regulations demand meticulous attention to data accuracy, reporting compliance, and equity management. As companies navigate these requirements, having the right tools by your side becomes non-negotiable.

And our suggestion? Compport!

Compport's comprehensive suite of pay equity management solutions helps organizations streamline compliance processes while building equitable workplaces.

From automated pay band creation to detailed analytics, our platform supports your transparency journey every step of the way.

Ready to transform your pay transparency approach?

FAQs

What is the pay transparency law in Brazil?

Brazil's pay transparency law, enacted in July 2023, requires companies with 100+ employees to submit biannual reports on gender pay gaps and implement measures to ensure equal compensation for equal work.

What is the Equal Pay Act in Brazil?

Equal Pay Law 14.611/2023 establishes requirements for pay equality regardless of gender, race, ethnicity, origin, or age, with mandatory reporting, transparency mechanisms, and penalties for non-compliance.

How does pay equity software help implement pay transparency?

Pay equity software like Compport automates data analysis, maintains compensation bands, and provides real-time insights on pay gaps, helping organizations meet compliance requirements while ensuring fair compensation practices.

What are the reporting deadlines for Brazil's pay transparency reports?

Companies must submit reports biannually - in March (covering July-December) and September (covering January-June). The next major deadline is September 30, 2024, with mandatory publication on company platforms.

What happens if pay gaps are identified in the transparency reports?

Companies have 90 days to develop an action plan addressing identified gaps. The plan must include union input and timeline for corrections. Non-compliance can result in fines up to 3% of payroll.

.svg)

%20(55).png)

%20(54).png)

%20(53).png)